Double, Double Toil and Trouble – Deflation Risk Back in 2022

deflation.com

There could be a glut in goods next year.

I try not to shout at the TV, but I can’t help myself whenever I hear a talking head on the financial channel say, “markets hate uncertainty.” This is utter nonsense. Markets LOVE uncertainty. It’s the very reason they exist. What the talking heads get confused with is that the phrase should be “business hates uncertainty.” If you are running an import / export business for instance, you need certainty in rules and regulations, supply chains etc. so that you can plan your logistics.

The World War C-induced economic lockdowns have, of course, meant that companies have had to navigate a huge amount of uncertainty. Domestic demand has remained buoyant in many countries, but supply chain issues have meant that many goods and materials have become relatively scarce (like microchips), and this has had a knock-on effect into higher prices. Producer and consumer price inflation have accelerated markedly. However, there is a growing awareness that perhaps that might change next year as shortages turn into gluts.

Satellite images such as these show container ships waiting at ports around the world from LA to Singapore and Piraeus. Many of these loads will contain products that are in demand now, but there is an emerging focus on the probability that they might not. Many companies have been engaged in double or even triple ordering what they would normally require in an effort to insulate themselves from the uncertainty. This could very well point to too many goods relative to demand next year. One fleet-management company executive is quoted as saying during a conference call hosted by logistics company Prologis, “There will be a glut. Like, we’re forgetting that part. Every scarcity period is followed by a glut, which is going to screw us up again in another way.”

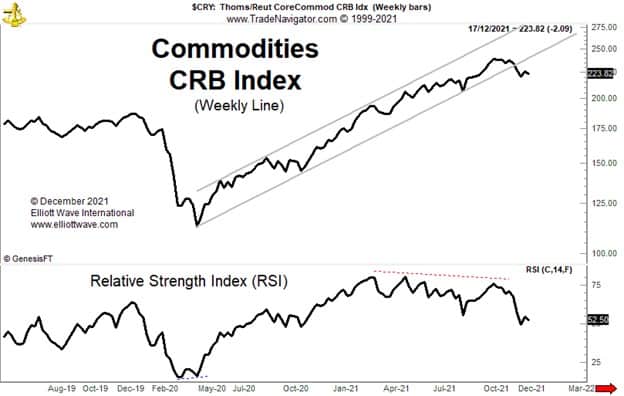

Perhaps the commodity markets are already sniffing this year’s price inflation turning to next year’s deflation. The chart below shows that the CRB index has broken below its uptrend channel, finally succumbing to trend exhaustion as displayed by the divergence with RSI.

So, as Shakespeare wrote, “double, double toil and trouble.” Could 2022 be, “like a hell-broth boil and bubble”? Stay tuned to deflation.com to keep ahead of the herd.